According to the CBN’s financial system’s strategy (2020), mortgage finance requirement for the country is conservatively placed at between 15-20 trillion naira, also house stock is estimated at 10.7 million, out of which only about 5% is financed via a formal mortgage system.

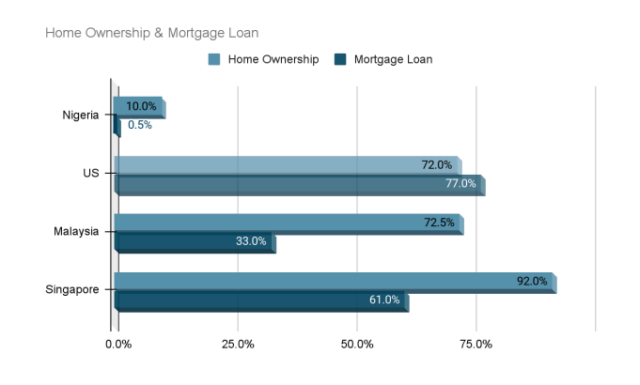

Home ownership in Nigeria is put at 10% compared to 72%(US), 72.5%(Malaysia), 92%(Singapore), while outstanding mortgage loans are pegged at 0.5%(2005) of GDP compared to 77% (US), 33% (Malaysia), 61% (Singapore).

The primary mortgage market has a long-term constraint of funding, which resulted in its redundant growth. Housing microfinance scheme and Guarantee Programme set up a framework to provide innovative housing microfinance for lower income Nigerians, available for incremental building and home improvements.

What are the deficiencies present/ current issues within the Nigerian Mortgage system?

Nigeria has experienced a low mortgage penetration, and certain factors account for this occurrence. High interest rates, tedious enforcement procedures, extravagant registration costs, low mortgage literacy, amongst other issues constitute a myriad of factors. Equally contributing, is Nigeria’s inability to maximize the potential economic benefits within the industry, an absence of access to low cost funding, weak legal framework, inadequate housing supply, and undercapitalized mortgage banks are other factors contributing to this.

Following the CBN’s Economic and Financial Review (2019), Nigeria’s housing deficit currently stands at an estimated 20million units, with a constantly increasing population of about 217 million people, and the need for housing rising rapidly by about 20% a year in cities such as Lagos, Ibadan, Kano and Abuja. Thus, the implication is that Nigerians are having to spend about 60% of their disposable income on rents as opposed to the recommended average of 20-30% by the UN. . This is reflected in the falling rate of home-ownership which has declined from 51% in 1991 to 24% in 2016. This data is not far-fetched from the result of steady increasing house prices without a correlating increase in average earnings.

Building or buying a home is a capital intensive project, and the need for sustenance in a continuously diminishing economy births the necessity for viable options for property acquisition. As an important aspect of the residential market, the mortgage system is pivotal to the overall real estate industry. With interest rates for mortgage products ranging between 15% to 25%, depending on the policy of financial institutions, and lack of access to low cost mortgage funding, the high interest rate remains a challenge for mortgage financiers, as well as acquirers.

What role has the Government played in providing Low Cost Funding in recent times?

The duty of the Federal Mortgage Bank is to supply the mortgage and housing markets with sustainable liquidity in order to support the advancement of home ownership amongst Nigerians anchored to mortgage financing. Equally it also regulates the activities of primary mortgage loan operators. In order to meet this mandate, the FMBN has shifted the operational emphasis from a focus only on social housing on-lending under the National Housing Fund Scheme. The National Housing Fund Scheme provides loans to Nigerians for erecting, purchasing or renovating houses. In particular, it encourages programmes which would enhance housing financing among low and medium income earners. The fund also services the non-salaried informal sector.

Whilst the CBN, primary mortgage banks, and other related entities play a vital role in the Nigerian mortgage market, the Nigerian Mortgage Refinance Company (NMRC) continues to actively drive changes in policies to effect a widespread penetration and implementation. One of which is the reformation of the Model Mortgage and Foreclosure Law, which concentrates on key provisions such as non-judicial foreclosure, establishment of a mortgage registry, shortened perfection period, introduction of concept of strata title, reduction of perfection costs, amongst other relevant industry policies.

According to Nigeria Mortgage Refinance Company (NMRC), while aiming to achieve increased liquidity in the mortgage market through commercial and mortgage banks, and providing accessibility to affordable quality housing for Nigerians, the NMRC makes provisions for mortgage lending institutions and financiers to access long term finance at affordable interest rates as well as longer tenors. Thereby, mitigating against the lack of finance for mortgage loans for lengthy periods, as aforementioned.

How is Low Cost Funding Accessible?

The Nigerian Housing Fund (NHF) grants entitlement to gainfully employed citizens who are above the age of 21 years, to a government funded loan of low interest, with a contribution of 2.5% of their monthly salary to the fund through the FMBN. The provision previously offered a maximum of 5 million which has been increased to 15 million, is repayable with a 6% interest over a period of 30 years. With the CBN having licensed over 35 primary mortgage banks, this provision is available to citizens who meet up to the stipulated requirements.

The objective of a primary mortgage institution (PMI) in Nigeria is to achieve continuous provision of affordable housing, and in acquiring a mortgage, it is poignant to consider the options of the fixed rate loan; where the interest rate remains static for the entire life span of the loan, or the adjustable rate loan; wherein the interest rate fluctuates depending on the financial markets.