GDP can act as a reasonable estimator for the progression of residential and commercial real estate markets. Over the years, Real Estate has compelled attention and is distinguished as an asset class. Global real estate provides prominent investment characteristics: a steady long-term income, the potential for capital appreciation, stability and significant diversification benefits. This is evidently the case in most countries where structural, long-term, and sustainable economic growth has been persistent over the recent years. In fact, as GDP growth is the main driver of real estate prices and rents, real estate investments directly participate in the strong growth of these economies.

A major driver of economic growth, Housing plays a vital role in the growth and development of an economy. According to the National Association of Realtors (NAR), a research on the total economic impact of real estate related industries on the state economy concluded on Housing being a means of shelter, and a source of income, by means of rent. The tie between Housing and Economic Growth is better comprehended by a consideration of relevant factors that facilitate the process of development necessitated by industry activities. According to the Jones Lang Lasalle (JLL) Global Real Estate Report 2014, Nigeria ranked among the top 10 most improved markets, and among the top 5 improved markets from Sub-Saharan Africa. The report states that GDP grew by 7.9% between 1999 and 2012. Following the National Bureau of Statistics (NBS), Gross Domestic Product (GDP) grew by 3.11% (year-on-year) in real terms in the first quarter of 2022, thus showing a sustained growth for six consecutive quarters since the recession witnessed in 2020, when negative growth rates were recorded in quarter two and three of 2020.

NBS reports that the oil sector in the first quarter of 2022 recorded daily oil production of 1.49 million barrels per day (mbpd), lower than the daily average production of 1.72 mbpd recorded in the same quarter of 2021 by 0.23mbpd and lower than the fourth quarter of 2021 production volume of 1.50 mbpd by 0.01mbpd, and the Agricultural sector grew by 11.5% year-on-year in nominal terms in Q1 2022, showing a fall of 3.59% points from the same quarter of 2021.

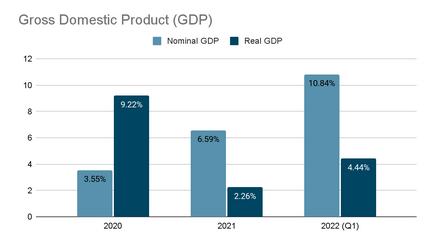

For Nominal GDP, Real Estate services grew by 10.84% in the first quarter of 2022, relatively higher by 2.79% points than the growth recorded in the first quarter of 2021, and 7.35% points higher as compared to the fourth quarter, 2021. For real GDP, the first quarter of 2022 recorded a 4.44% growth. This is higher than the growth reported in the first quarter of 2021 by 2.67% print, and higher by 2.96% points higher than the growth recorded in the fourth quarter of 2021. The Q1 2022 growth rate was higher than the 0.51% growth rate recorded in Q1 2021 by 2.60% prints and lower than 3.98% recorded in Q4 2021 by 0.88% points. Nevertheless, quarter-on-quarter, real GDP grew at 14.66% in Q1 2022 compared to Q4 2021, reflecting a lower economic activity than the preceding quarter. Punch Nigeria, as at November 2022 put forward that activities in the real estate and construction sectors contributed 20 trillion to the Nation’s GDP in the first three quarters of 2022, and following the NBS’ report, real estate contributed 7 trillion of the amount to the GDP.

According to Asiagreen Real Estate, studies in Asia, Europe, and the US reveal that median home prices correlate by as much as 60% to 95% with GDP per capita. In the long run the growth trends of both cycles typically correspond to each other. However, high correlation between GDP and real estate prices might not be given at all points in time. The prevalent real estate cycles do not always mirror GDP cycles, but often follow their own pattern. In the short and medium term, real estate dynamics are not just driven by a country’s prosperity, other determinants are equally relevant. These are, for example, urbanization rates, construction activity and demographic changes which all influence supply and demand temporarily.

The prominence of Real Estate Investment Trusts (REITS) in the stock markets has increased since 1985. In his paper, Evolution of Real Estate in the Economy, Olusegun Olanrele points out that Investment Trusts as a creation of the United States Congress through REIT legislation in 1960 has been globally accepted, and going by the United Nations Department of Economic and Social Affairs, the global population has reached 8 billion. With an estimated number of 216 million persons in Nigeria, that being 2.7% of the global population, Nigeria stands as the 6th most populous country, and its population size supports investment in real estate. This is due to increased demand for housing and other types of real estate property. Political risk may explain shortage of investment funds in emerging economies. Nonetheless, the reality of the Nigerian market is that there is a quantum of return on investment. Going by the Trading Economics Global Macro Models and Analysts expectations, Nigeria is expected to reach 2400 USD by the end of 2022.

According to Wharton University of Pennsylvania, the percentage of values added attributed to real estate has been fairly steady over time, with its importance growing slightly in the late 1990s. This growth can be attributed to the increasing role of real estate finance and insurance. For households, owner-occupied homes represent the vast majority of real estate wealth. The World Bank Open Data 2016 affirmed an increase in housing demand in Kano, Lagos and Ibadan by 20%, while proposing that by 2037, the urban population will have doubled. In 2019, a surge in demand for housing in the Nigerian market was noted by a 72% increase in property listing enquiries, following a year-end report by Nigerian Property Center. This growth was however affected in 2020, the year of the Pandemic, and according to the Global Property Guide, “In an effort to buoy economic activity amidst the pandemic, the Central Bank of Nigeria (CBN) recently approved NGN 200 billion (US$ 520 million) in mortgage finance to fast track construction of 300,000 social housing units for low-income households, and to create new jobs for the unemployed.”

Samuel Zell of the Real Estate Center, Wharton University of Pennsylvania posits that about 11% of global GDP each year is attributable to the real estate industry. The value of real estate in debt and equity markets have increased substantially, and securitization of mortgage and commercial mortgage have made real estate an increasingly important component in measuring economic growth.